Hanwha Philly Shipyard, acquired by Hanwha Group, is rising as a new model for rebuilding the American shipbuilding industry through large-scale investments and all-encompassing cooperation with the local community. In particular, the shipyard is receiving praise for quietly achieving success in its localization strategy, in stark contrast to the recent crackdown on Korean company workers in Georgia, as it garners full support from local government and the private sector.

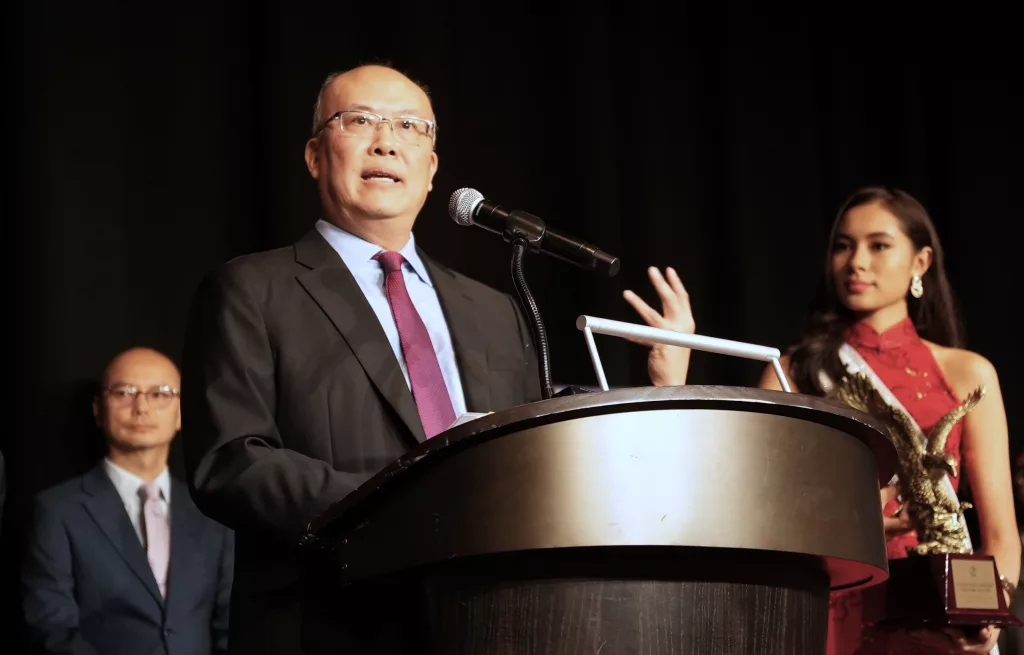

On October 3, the Asian American Business Alliance of Greater Philadelphia (AABAGP) Golden Eagle Award Dinner in Philadelphia drew over 400 local politicians, business leaders, and community figures who listened intently to a speech by David Kim, CEO of Hanwha Philly Shipyard. The event served as an excellent opportunity to explain to Philadelphia’s business community and residents the shipyard’s $5 billion investment plan and its ripple effects on the Philadelphia industrial ecosystem.

Reviving Lost Dreams: The Blueprint of a $5 Billion Investment

David Kim, a Korean-American born and raised in Texas and an MBA graduate from the Wharton School at the University of Pennsylvania, detailed Hanwha’s $5 billion (approximately 7 trillion KRW) infrastructure investment plan, emphasizing the vision of Hanwha Philly Shipyard and the grand dream of the ‘MASGA (Make American Shipbuilding Great Again)’ project.

CEO Kim stated, “Hanwha acquired the Philly Shipyard in December 2024, and nine months later, sometimes I tell people it’s been so hectic, it feels like nine years. But in any case, it’s been a great journey

so far and a lot of support from the community, as well as the people around us.”

He reminisced about the shipyard’s past, where it had dwindled to fewer than 100 employees just a few years ago and faced closure, before revealing that over 1,700 workers are now employed there. He stressed, “We’re here to not only just kind of grow from a company perspective, but also beyond that, to grow and to be part of the Philadelphia the regional community, but also to help revitalize the U.S shipbuilding industry.”

Hanwha’s $5 billion investment will fund renovations leveraging cutting-edge technology, including the addition of two docks and three piers, as well as the expansion of block assembly facilities. The shipyard has already secured initial orders from affiliate Hanwha Shipping for 10 medium-sized tankers and one LNG carrier. In the long term, it plans to establish a strategic foothold for U.S. Navy vessel maintenance, repair, and overhaul (MRO) services, as well as warship contracts.

CEO Kim revealed, “The yard right now builds about 1 to 1 half ships a year. Our growth aspirations to do 20 a year.” He added, “So that is no small feat. And we’ve already seen some of the positive impact of that, not just in terms of the jobs that we’ve created, but also what we’ve been able to do for the local economy.”

Full Support from the Local Manufacturing Sector

The success of Hanwha Philly Shipyard is generating high expectations in Pennsylvania’s private business sector as well. David N. Taylor, President of the Pennsylvania Manufacturers’ Association (PMA), who attended the dinner, highlighted the impact of Hanwha’s investment.

In his keynote speech, Taylor emphasized, “Manufacturing is the engine that drives Pennsylvania’s economy, generating more than $110 billion dollars every year and directly employing over a half million Pennsylvanians on the plant floor.” Noting the ripple effects of the shipyard’s expansion, he said, “Manufacturing also has the strongest multiplier effect of any sector. That activity on the plant floor sustains millions of additional Pennsylvania jobs in supply chains, distribution networks and vendors of industrial services. That multiplier effect also creates induced jobs that result from the purchasing power and economic growth generated by the manufacturing dynamic.” The increased demand for steel, components, and services from Hanwha Philly Shipyard is expected to spur growth in adjacent industries and aim to create up to 5,000 skilled new jobs.

Success Model of Localization Through the ‘Philadelphia Task Force’

Hanwha’s strategy clearly distinguishes itself from cases where other Korean investments in the U.S. faced discord over labor and regulatory issues. In contrast to the diplomatic controversy sparked by the last September arrest of Korean workers at a Hyundai-LG battery plant in Georgia, Hanwha is focusing on transparent, community-centered collaboration.

The ‘Pennsylvania-Hanwha Leadership Task Force’ (PHL Task Force), jointly established by the Pennsylvania state government and Hanwha, is at the core of this cooperation. Aimed at expediting permitting processes, securing and training skilled labor, the task force has drawn strong interest from Pennsylvania Governor Josh Shapiro, who joined President Lee Jae-myung during his August visit to the shipyard. Shapiro has already invested over $34 million to support the shipyard and Navy Yard expansions.

U.S. Senator Dave McCormick (R-PA), a co-sponsor of the pending Ships for America Act in Congress, has visited Hanwha Philly Shipyard multiple times, including in April with Transportation Secretary Sean Duffy, and has been actively advocating for support in Congress. He has long argued that strengthening U.S. shipbuilding capabilities is essential for bolstering national defense, stimulating the economy, and creating skilled American jobs.

Through its sustainable localization strategy, CEO Kim stated, “From Philadelphia’s hotels and restaurants to transportation and sports industries, everyone is benefiting from this change,” promising growth that encompasses indirect employment effects through local subcontractors.

CEO Kim particularly noted, “About 15% of our employees are Asian-American,” emphasizing cultural diversity and inclusion at the shipyard. This reflects the CEO’s strong commitment to fostering an organizational culture where multicultural talent can collaborate harmoniously.

CEO Kim led the acquisition and integration of the Philly Shipyard by Hanwha. Previously, he served as Vice President of Hanwha Defense USA and as CFO and CSO of Hanwha Energy USA Holdings Corp. His background in defense, energy, and global operations equips him with the expertise to prepare for both commercial shipbuilding and Navy contracts.

As Hanwha eyes further entry into the U.S. defense sector, appointing Kim can be seen not merely as placing an operator for the shipyard, but as part of a mid- to long-term strategy.

Maximizing Growth Potential Through Smooth Initial Orders

Since Hanwha acquired the Philly Shipyard in December last year, Hanwha Philly Shipyard has secured orders for a total of 12 new vessels. These contracts were placed by Hanwha Shipping, a U.S. subsidiary of Hanwha Ocean.

Among the new orders, securing two high-profitability liquefied natural gas (LNG) carriers stands out as a key asset for the Hanwha Group’s commercial shipbuilding efforts in the U.S. market. This achievement marks the first export-eligible LNG carrier order for a U.S. shipyard in nearly 50 years. Hanwha Shipping has also exercised an option for an additional LNG carrier, laying the groundwork to preempt demand in the U.S. commercial sector.

Additionally, Hanwha Philly Shipyard has received orders from Hanwha Shipping for 10 MR-class tankers and chemical product carriers, known as the largest commercial vessel order for a U.S. shipyard in over 20 years.

Prior to Hanwha’s acquisition, Philly Shipyard was progressing on contracts to build five National Security Multi-Mission Vessels (NSMVs) for the U.S. Maritime Administration (MARAD) and three LNG-fueled container ships for Matson Navigation.

The NSMVs for MARAD serve as training ships and vessels for humanitarian aid and disaster relief, demonstrating capabilities in military vessel manufacturing. The second vessel was delivered in September, with the remaining ships at various stages of construction.

The commercial contract with Matson Navigation involves three ‘Aloha Class’ container ships using LNG dual-fuel propulsion, valued at approximately $1 billion, scheduled for delivery in 2026 and 2027. Previously, Philly Shipyard built two Aloha Class container ships for Matson in 2018 and 2019.

It also secured a contract in November 2021 from Great Lakes Dredge & Dock Co. to build one Submarine Rock Installation Vessel (SRIV). In 2013, it entered a joint investment agreement with Crowley Maritime to build eight tankers (with options for four more). In 2014 and 2015, it delivered two Aframax tankers for SeaRiver Maritime, a subsidiary of ExxonMobil.

Key to Business Success: Profitability and Policy Consistency

Bolstered by the $5 billion investment, Hanwha Philly Shipyard has the potential to expand annual revenue to $4 billion in the long term. However, due to the shipbuilding industry’s long construction cycles, analyses suggest it may take time to secure initial profitability.

For sustained growth, the shipyard must stably secure skilled local talent aligned with the pace of advanced technology adoption, ensure supply chain stability for key components like steel and navigation systems, and comply with certifications and security requirements for long-term goals such as U.S. Navy contracts.

Nevertheless, Hanwha Philly Shipyard is regarded as one of the most successful models of foreign investment and U.S.-Korea industrial collaboration in America, thanks to the state government’s proactive support and close ties with the local community.